Sparks are flying over taxes that primarily affect Republicans representing districts in Democrat-controlled states, sending tensions skyrocketing as GOP lawmakers negotiate President Donald Trump's "big, beautiful bill."

The fight more specifically is about state and local tax deductions, colloquially known as SALT.

Republican lawmakers representing high-cost-of-living areas outside big cities had been pushing leaders to raise the current cap on SALT deductions – $10,000 for both single filers and married couples – in Trump's bill.

However, on Thursday night, leaders of the House's SALT Caucus emphatically rejected what they said was an offer from GOP leaders to raise that deduction to $30,000.

SCOOP: REPUBLICANS DISCUSS DEFUNDING 'BIG ABORTION' LIKE PLANNED PARENTHOOD IN TRUMP AGENDA BILL

"We've negotiated in good faith on SALT from the start— fighting for the taxpayers we represent in New York. Yet with no notice or agreement, the Speaker and the House Ways and Means Committee unilaterally proposed a flat $30,000 SALT cap — an amount they already knew would fall short of earning our support," the statement said.

"It's not just insulting — it risks derailing President Trump's One Big Beautiful Bill. New Yorkers already send far more to Washington than we get back — unlike many so-called ‘low-tax’ states that depend heavily on federal largesse. A higher SALT cap isn't a luxury. It's a matter of fairness. We reject this offer."

The statement was signed by Reps. Mike Lawler, R-N.Y., Nick LaLota, R-N.Y., Elise Stefanik, R-N.Y., and Andrew Garbarino, R-N.Y.

However, not all of their delegation is on board.

Rep. Nicole Malliotakis, R-N.Y., whose district spans a sliver of south Brooklyn and all of Staten Island, told Fox News Digital first that she could support a $30,000 cap.

"Everyone needs to advocate for the needs of their district. Tripling the deduction to $30,000 will provide much-needed relief for the middle-class and cover 98% of the families in my district," she said.

However, a spokesperson for Johnson pointed out that there was no commitment made on any number.

Press secretary Athina Lawson wrote on X alongside a report that Johnson "acknowledged" the $30,000 number, "To add vital, missing context: What the Speaker actually said is this is one number among others in ongoing discussions amongst members."

She referenced comments Johnson made to reporters on Thursday when asked about the figure. "I’ve heard that number, and I’ve heard others as well."

"It’s still an ongoing discussion amongst the members," Johnson said. "I’m not going to handicap it because I’m not sure exactly what that is, but there’s a lot of analysis that’s going into it."

The Republican majorities in the House and Senate are working on advancing Trump's agenda via the budget reconciliation process, which allows the party in power to move a massive piece of legislation without the opposing party's input, provided it deals with budgetary and other fiscal matters.

It is a massive effort across multiple committees of jurisdiction.

The Ways & Means Committee, the House's tax-writing panel, is expected to unveil its portion of the bill within days.

BROWN UNIVERSITY IN GOP CROSSHAIRS AFTER STUDENT'S DOGE-LIKE EMAIL KICKS OFF FRENZY

A meeting to advance that legislation is expected Tuesday afternoon, people familiar with the planning told Fox News Digital.

Malliotakis is the only member of the committee who is also a member of the SALT Caucus.

Republicans in California, New York and New Jersey have been pushing for the reconciliation bill to lift the SALT deduction cap, which was first implemented in Trump's 2017 Tax Cuts and Jobs Act.

Some lawmakers have proposed lifting the cap to as high as $100,000, which Republicans in other areas have largely rejected.

The blue state Republicans pushing for a larger deduction have argued the issue is critical for their constituents.

They are also the most vulnerable lawmakers in the House GOP Conference, and their seats are key to Republicans holding onto their slim majority.

Republicans in favor of raising the SALT deduction have also pointed out that while it benefits people in high-cost-of-living areas outside big cities, it is those states that send more tax dollars back to Washington for programs that ultimately benefit the entire country.

However, others in conservative circles have pushed back on their efforts.

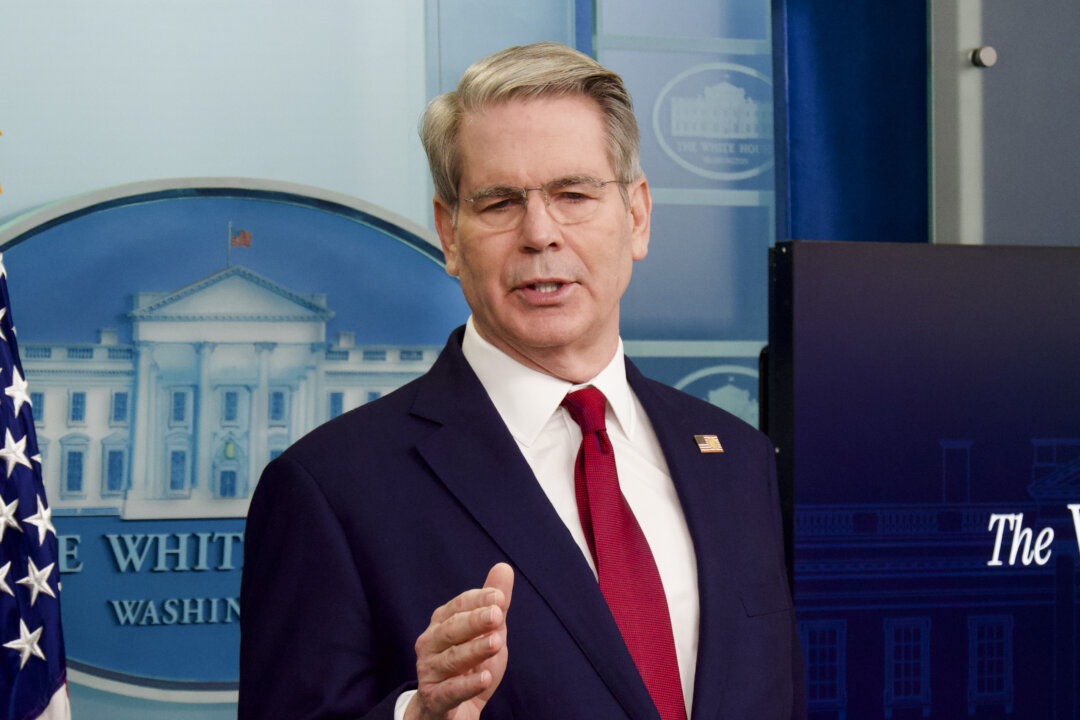

"The Republican margin is so small in the House that a handful of New England Republicans have a lot of sway over this bill and are pushing to raise that deduction," said Marc Short, an alumnus of Trump's first administration who played a key role in the 2017 tax negotiations.

"I think from a tax perspective, what's unfair about that is you're basically taking much of middle America that live in states that are better governed and asking them to subsidize the residents in states that are poorly managed and continue to generate huge deficits."

.png)

6 hours ago

2

6 hours ago

2

English (US)

English (US)