The United States once led the world in manufacturing, producing more than 25% of global industrial output. Today, China holds that title, controlling over 30%, while the U.S. struggles to maintain even half that share.

Plenty of factors drove this decline — decades of offshoring, the collapse of industrial job bases, and an obsession with short-term profits over long-term strength. But if America wants to reclaim its industrial leadership and restore economic self-reliance, we need more than reshoring slogans and infrastructure bills.

Innovation isn’t an expense. It’s an investment — in national security, in American workers, and the future of US leadership.

We must fix and expand the research and development tax credit.

A recent Wall Street Journal analysis focused on our loss of industrial capacity. But capacity starts with innovation. Every new factory, process, and product begins with research — and that remains our greatest untapped advantage.

Yet Congress has punished companies for investing in R&D. Since 2022, the tax code has forced businesses to amortize R&D expenses over five years instead of deducting them immediately. That change has choked innovation, especially among small and midsized manufacturers that depend on near-term tax relief to fund future growth.

The result? Reduced domestic innovation, fewer advanced manufacturing breakthroughs, and an economy less equipped to compete with subsidized foreign rivals.

R&D incentives work

The research and development tax credit was meant to drive economic growth. It helps businesses offset the steep costs of developing new technologies, improving production, and staying competitive.

But today’s credit falls short. It’s too small, too complicated, and — after the amortization change — actively harmful.

Now compare that to China. Beijing offers “super deductions,” direct subsidies, and aggressive industrial policies tailored to national priorities. The results speak for themselves: China leads in semiconductors, solar, electric vehicles, and other strategic industries.

Four immediate fixes

To reverse course and restore American competitiveness, Congress must act.

- Restore full expensing of R&D investments so businesses can deduct costs in the year they’re made — not years later.

- Expand the R&D credit to reach startups, family-owned manufacturers, and small tech firms that often drive innovation but struggle to access support.

- Streamline eligibility rules and reduce audit risks that discourage many companies from claiming the credit at all.

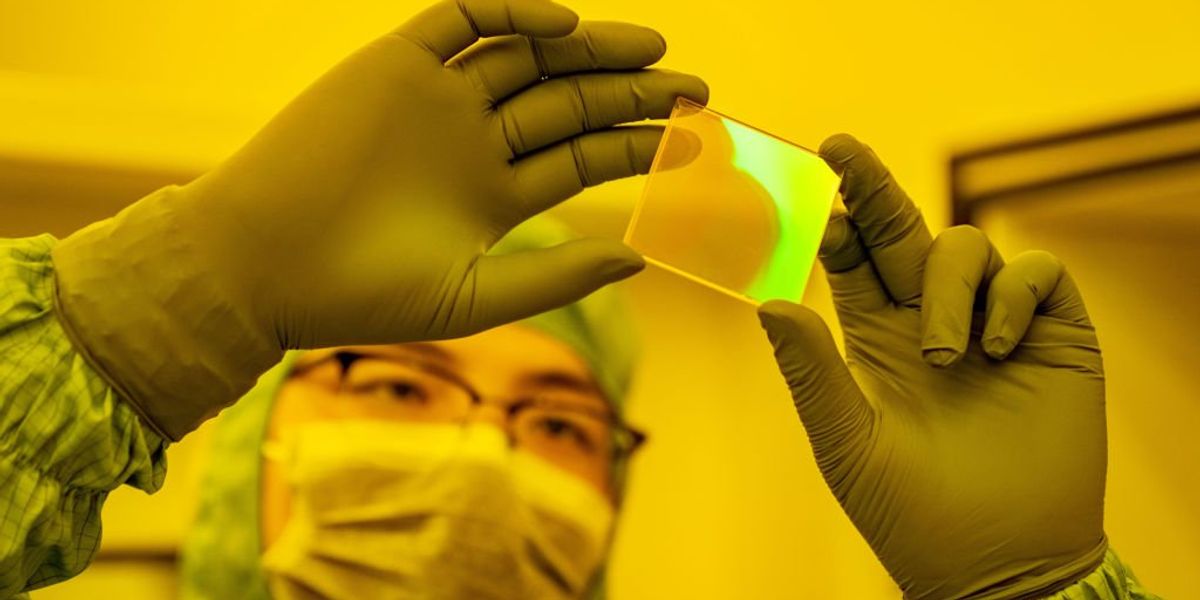

- Create bonus credits for R&D tied to domestic manufacturing in key sectors like semiconductors, energy, defense, and infrastructure.

R&D as economic infrastructure

American manufacturing won’t come back without innovation. You can’t revive the auto industry, reshore chip production, or scale clean energy without continuous investment in research and development. And without smart tax policy to back it, capital won’t go where it’s needed.

Lawmakers in both parties love to talk about supporting U.S. industry. But support doesn’t come from speeches — it comes from policy. If Congress is serious about restoring American manufacturing, it should start by fixing the one tax tool designed to keep us competitive.

The auto industry didn’t boom just because someone built a car. It took Ford’s innovation of the assembly line and the machines to make it work. Thomas Edison didn’t invent the light bulb — he made it viable. Steve Wozniak didn’t invent the microchip, but he made the personal computer scalable.

Inventors didn’t build the modern economy. Innovators did.

Innovation isn’t an expense. It’s an investment — in national security, in American workers, and in the future of U.S. leadership.

.png)

3 hours ago

1

3 hours ago

1

English (US)

English (US)